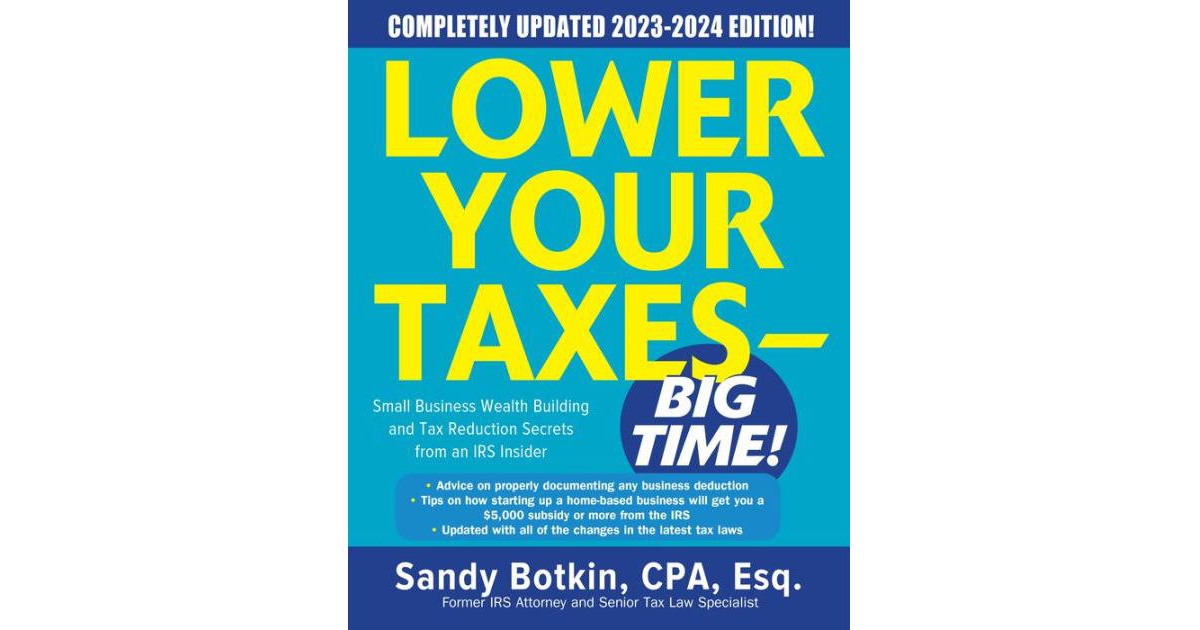

The authoritative guide for navigating tax time, completely revised and updated for 2023-2024. With 200,000+ total copies sold, Lower Your Taxes - Big Time has helped hundreds of thousands of taxpayers save money for 20 years. Now refreshed for 2023-2024, this go-to guide is more topical than ever and includes all the current information you need to know about the latest changes in tax code. The ninth edition of Lower Your Taxes - Big Time shows you how to save thousands of dollars-legally and ethically -during tax time. It offers proven methods for taking advantage of the tax system to get a yearly subsidy of 5,000 or more back from the Irs-and bulletproof your records forever. Key topics include- advice on properly documenting any business deduction, tips on starting a home-based business, turning tuition, entertainment, orthodontia, and other expenses into huge deductions. The new standard deduction for married couples, changes to business meal and lease deductions, vehicle purchases and health Flexible Spending Account (Fsa) contributions. Known for his engaging, humorous writing style, Botkin is a renowned expert who has worked for the Irs in multiple capacities, he knows the tax code inside and out. Whether you're a consultant, small-business owner, independent contractor, or just an individual seeking to protect your hard-earned nest egg.